Abstract

The purpose of this document is to outline a coherent implementation and

deployment strategy for the Web Payments standardization work at W3C.

Status of This Document

This section describes the status of this document at the time of its publication.

Other documents may supersede this document. A list of current W3C publications and the

latest revision of this technical report can be found in the W3C technical reports index at

http://www.w3.org/TR/.

This document is a work in progress and is being released early and often

using an agile process; it is incomplete.

This document was published by the Web Payments Interest Group as an Editor's Draft.

If you wish to make comments regarding this document, please send them to

public-webpayments-comments@w3.org

(subscribe,

archives).

All comments are welcome.

Publication as an Editor's Draft does not imply endorsement by the W3C

Membership. This is a draft document and may be updated, replaced or obsoleted by other

documents at any time. It is inappropriate to cite this document as other than work in

progress.

This document was produced by a group operating under the

5 February 2004 W3C Patent

Policy.

W3C maintains a public list of any patent

disclosures

made in connection with the deliverables of the group; that page also includes

instructions for disclosing a patent. An individual who has actual knowledge of a patent

which the individual believes contains

Essential

Claim(s) must disclose the information in accordance with

section

6 of the W3C Patent Policy.

This document is governed by the 1 August 2014 W3C Process Document.

1. Introduction

The purpose of this document is to outline a coherent implementation and

deployment strategy for the Web Payments standardization work at W3C. It

consists of the following major sections:

-

Section 2: Terminology defines common terminology

used throughout the document.

-

Section 3: Coordination describes the different

groups involved in the work and how they will coordinate to achieve the

long-term vision [WEB-PAYMENTS-VISION] of the Web Payments work.

-

Section 4: Web Payments Phase 1 is

separated into subsections detailing: 1) Strategic goals for the phase,

2) Use cases that should be achievable by the end of the phase, 3)

Capabilities that are targeted and which groups are responsible for

delivering the capabilities, 4) A list of relevant groups that will participate

in the phase as well as what they will be working on during the phase, and

4) Deployment goals and strategies to achieve adoption.

1.1 Relationship to Other Documents

This document is one part of a greater body of work around Web Payments that

the Web Payments Interest Group

at W3C is producing. These other documents include:

-

A Vision for Web Payments

describes the desirable properties of a Web Payments architecture.

-

Web Payments Use Cases

1.0 is a prioritized list of all Web Payments scenarios

that the Web Payments Interest Group expects the architecture to address

in time.

-

Web Payments Capabilities 1.0

derives a set of capabilities from the use cases that, if standardized, will

improve payments on the Web.

-

Web Payments Roadmap 1.0

(this document) proposes an implementation and deployment plan that will result

in enhancements to the Open Web Platform that will achieve the scenarios

outlined in the Use Cases document and the capabilities listed in the

Capabilities document.

2. Terminology

This document attempts to communicate the concepts outlined in the Web

Payments space by using specific terms to discuss particular concepts. This

terminology is included below and linked to throughout the document to aid

the reader:

- entity

- A person, organization, or software agent that is capable of

interacting with the world.

- payee

- An entity that receives funds as required by a transaction.

- payer

- An entity that provides a source of funds as required by a

transaction.

- payment instrument

- A mechanism used to transfer value from a payer to a

payee. Examples: Corporate Visa card, personal Visa card, a

bitcoin account, a PayPal account, and an Alipay account. [PSD2] any

personalized device(s) and/or set of procedures agreed between the

payment service user and the payment service provider and used in

order to initiate a payment order. [ECB] a tool or a set of procedures

enabling the transfer of funds from a payer to a payee.

- payment processor

- An entity that submits and processes payments using a

particular payment instrument to a payment network. Examples:

Stripe, PayPal, Authorize.net, Atos, FedACH.

- payment scheme

- Sets of rules and technical standards for the execution of payment

transactions that have to be followed by

adhering entities (payment

processors, payers and payees). Examples: Visa, MasterCard, Bitcoin, Ripple,

PayPal, Google Pay, Alipay, Yandex money, ACH, SEPA. [ECB] a set of

interbank rules, practices and standards necessary for the functioning

of payment services.

- transaction

- An economic exchange between a payer and one or more

payees. An agreement, communication, or movement

carried out between a buyer and a seller to exchange an asset for

payment.

- transfer order

- [ECB] an order or message requesting the transfer of assets (e.g.

funds, securities, other financial instruments or commodities) from

the debtor to the creditor.

- wallet

-

a software service, providing similar functions in the digital world

to those provided by a physical wallet, namely:

- It holds payment instruments registered by the wallet

owner;

- It supports certain payment schemes and enables the payer to

use registered payment instruments to execute a payment in

accordance with that scheme;

- It may hold one or more balances of some digital asset that

can be used to make payments.

This definition of wallet may expand in the future to include

other items people find in physical wallets such as digital

receipts, coupons, and identification.

3. Coordination

In order for the Web Payments Activity to succeed, multiple groups will need

to coordinate work in key areas related to payments, commerce,

identity/credentials, and security. The diagram below outlines the categories

that each group will participate in as well as the phases the groups will

be active in:

4. Web Payments Phase 1

The initial implementation of the Web Payments work will start in October 2015

and will focus on delivering standards for a Minimum Viable Platform (MVP)

by December 2017.

4.1 Goals

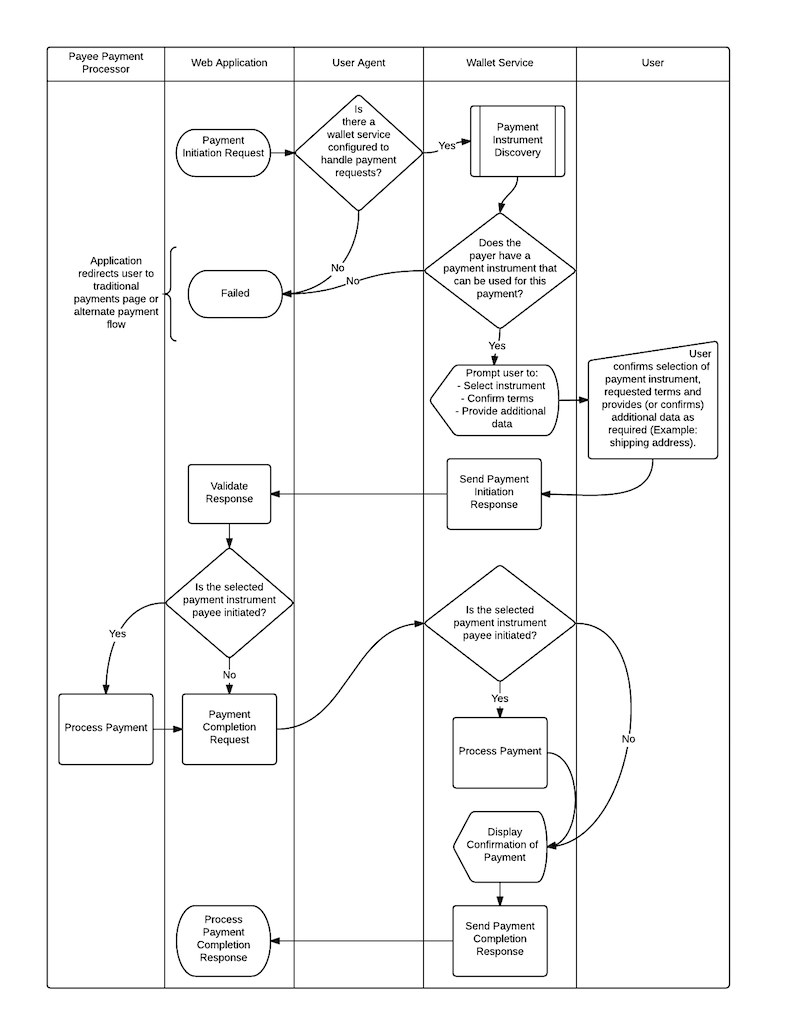

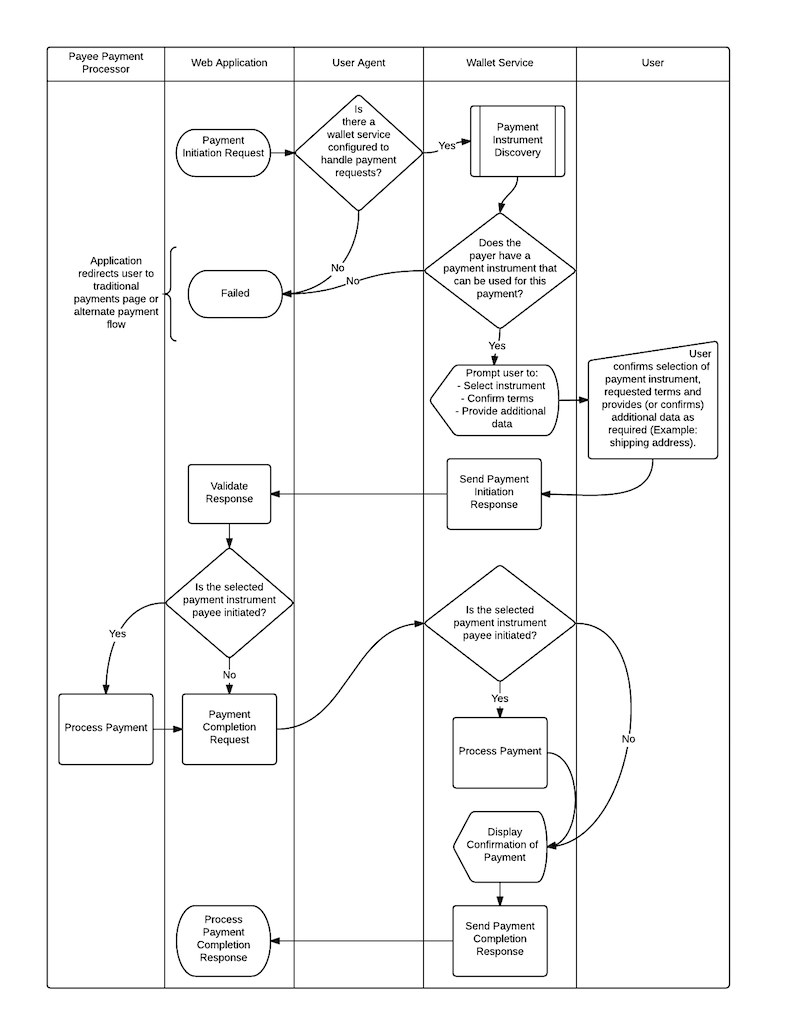

The scope of work supports the following elements of a basic purchase

triggered by user interaction with a Web application initiating a new

payment. These standards define a high-level message flow for a payment

from payer to payee either in the form of a credit push (payer

initiated) or a debit pull (payee initiated) payment, and can be used to

facilitate a payment from any payment scheme.

- Pre-Payment

-

- Registration, by the payer with their

wallet, of any conforming payment

instrument they wish to use on the Web (e.g. a credit or

debit card, electronic cash, cryptocurrency, etc).

- Negotiation of Terms

-

- Payment Initiation Request, by the payee to

the payer providing the terms of the payment including elements

such as the accepted payment schemes, price, currency, recurrence,

transaction type (purchase, refund etc.), timeout and requests for

any additional data that is required from the payee.

- Negotiation of Payment Instruments

-

- Discovery, by the payer, of their available

payment instruments that can be used to make the payment. This is

done by matching those registered by the payer with those

supported by the payee (as defined in the Payment Initiation

Request), while keeping information local to the payer.

- Selection of a payment instrument by the

payer, confirmation of the terms, and sending of any requested

data back to the payee for validation.

- Payment Processing and Completion

-

- Execution of the payment by either payer or payee.

- Delivery of a Payment Completion generated by

the entity that executed the payment. This may contain a

Proof of Payment if supported by the payment

scheme.

The group will also address exceptions that may occur during these

steps, including payment authorization failure.

4.2 Use Cases

The following use cases are in scope for phase 1 with specific limitations

expressed beside each use case:

The capabilities associated with each use case listed above can be found in

the

Web Payments Capabilities 1.0 document.

4.3 Groups and Scope

A list of relevant groups that will participate in the first iteration of

specification creation.

| Group |

Scope |

Charter |

|

Web Payments Interest Group

|

Continued development of use cases and requirements for phase 2.

Liason between larger W3C community and other relevant standards bodies.

|

October 2014 - December 2017

|

|

Web Payments Working Group

|

Invoking a payment request, selecting a payment instrument, initiating funds

transfer, delivering a proof of payment.

|

Draft Charter

|

|

Web Authentication Working Group

|

Secure authentication of entities (users, systems and devices) to enable

high-security Web applications. Based on FIDO Alliance work.

|

No charter yet

|

|

Hardware-based Security Working Group

|

A set of Hardware-Based Web Security standard services providing Web

Applications usage of secure services enabled by hardware modules

(Trusted Execution Environments, Secure Elements, and other secure enablers).

|

No charter yet.

|

Issue 1

It is currently unknown whether or not a Credentials WG or Linked Data

Security WG will be created.

-

Technical Architecture Group (TAG) (for reviews related to Web Architecture)

-

Security IG (for reviews about security)

-

Privacy IG (for reviews about sharing of sensitive information)

Related W3C Community Groups

-

Credentials

-

Web NFC

-

Web Payments

-

Web Bluetooth

-

Web Crypto API

-

Web of Things

4.4 Deployment and Adoption

Deployment in phase 1 will focus on enabling a few major online retailers

to run Web Payment agents to issue Web Payment invoices for processing at

1-2 major online Payment Service Providers (or banks). The payment

institutions would then initiate the payment and send a proof of payment

back to the retailer.

4.4.1 Goals

-

3 major online retailers launching Web Payments support (for example:

Alibaba, Walmart, Target, Best Buy, Overstock.com, Amazon, Tesco, eBay, etc.)

-

1-2 large online payment companies (or banks) launching Web Payments support

(for example: Google Wallet, PayPal, Alipay, Bank of America, HSBC,

US Fed, etc.)

-

5-10 smaller players from the online retail space and the payments space

-

1 million payments within the first year after standardization

-

Favorable reviews by the Web developer community

4.4.2 Strategies

-

Deployment strategy should be a pure software deployment. Do not require new hardware to be deployed.

-

Specifications should focus on technology that has already been prototyped.

-

All software should be cloud-only for phase 1. For example, do not try to

support both cloud and local wallets due to a possible conflict around the

"payment message bus" being implemented at the OS layer or the browser layer.

4.5 Unresolved Issues

Issue 2

Where we need an extensible message format, we will want to specify at least

a data model. The hard question will be whether we can achieve a single

serialization (e.g., JSON or JSON-LD or XML) or whether we need multiple.

Issue 3

What canonicalization (if any) is needed in our messages for the purpose of

digital signatures.