An important goal of Secure Payment Confirmation (SPC) is to streamline strong customer authentication (SCA). One way to reduce friction is to allow many authentications for a given registration. In other words, ideally the user registers once and can then authenticate “everywhere” (consistent with the policies of the relying party; they have to opt-in).

Several recent API design and implementation choices have expanded our vision of “everywhere.”

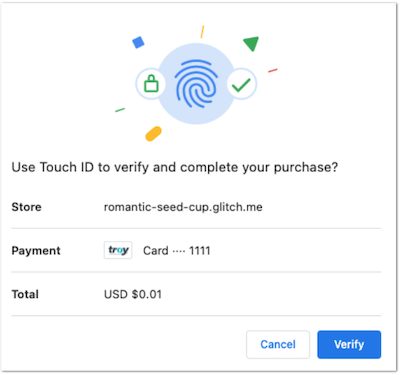

During an SPC authentication the browser displays a prompt to the user: do you wish to pay this amount to this merchant using this instrument? In the original SPC implementation the relying party (for example the bank or card issuer) provided the instrument information (a label describing the instrument and a icon) at registration time. This turned out to overconstrain the API, so now the instrument information is provided at authentication time. How does this expand “everywhere”? The user may have multiple instruments with a relying party (e.g., multiple cards or accounts with a bank). The new SPC approach allows the user to register once with the relying party and use that registration with multiple instruments. The relying party decides, at authentication time, which instrument information the browser should display.

In the original SPC implementation credentials were stored in the browser, which meant that as soon as the user moved to a new browser, a new registration would be required to use SPC. A second recent change has been making SPC work with (FIDO) discoverable credentials. This allows the browser to determine at authentication time if there is an authenticator that matches the credentials provided as input to SPC. Although discoverable credentials are not yet interoperable on all platforms, we are headed in that direction. How will this expand “everywhere”? First, the user can use SPC in a new browser on their device without a new registration; the existing registration is discovered on the fly at authentication time. Second, we hope to see wider adoption of technologies that let people use their mobile devices as authenticators during desktop authentication (e.g., caBLE). This should increase the range of authenticators with discoverable credentials.

The choice of relying party also has a direct impact on the scope of “everywhere.” If the relying party is, for example, an issuing bank, as long as other parties in the ecosystem (notably payment service providers) can query the bank for SPC credentials, the user should be able to authenticate on any merchant using any PSP for the same registration. That is the most expansive vision of “everywhere.” However, different stakeholders will move at different speeds for a variety of security and practical reasons. In the meantime, other parties may choose to play the relying party role. For example a payment service provider might act as the relying party. In this case (a form of delegated authentication), the user could reuse a registration across all merchants served by that payment service provider. The user would likely have to register anew with each new payment service provider. As a Working Group, our goal is to design the API to support a variety of flavors of relying parties: banks, companies that provide services to banks, companies that provide payment services to merchants, and so on.

Another axis of flexibility involves the integration of SPC into an underlying protocol. Payment service providers need to be able to ask relying parties (e.g., banks) for SPC credentials, and to return assertions to relying parties for validation. I am excited that the first SPC integration will be in EMV® 3-D Secure version 2.3. Likewise, as FIDO authentication becomes more commonplace for bank login experiences, I expect users will want the same type of experience for payments directly from their bank accounts. I hope that these integrations drive interest in the API and get us closer to “everywhere.”

We’ll talk about all of this in more detail soon at the Working Group’s October meeting.