Electronic Commerce Interoperability Standard

Appearance

ECIS stands for E-Commerce Interoperability Standard. an interoperability standard between service providers in decentralized web environment

What is ECIS?

- stands for Electronic Commerce Interoperability Standard

- it organize multiple e-commerce services with user agent centric mechanisms

- multiple service providers has their own service mechanism as an island

- user agent is the central point for multiple connectivities and inter-operations between service providers

- ECIS make connectivity to each service providers

- adding standard way to initiate e-commerce service request

- adding standard way to get response from service provider

Why ECIS is required?

- no standard method to exchange data between multiple service providers on the web

- no standard framework to exchange data between multiple service providers on the web

- because of above absent, current E-Commerce interoperation need complex integration and more resources.

- when user access shopping service provider(merchant)

- merchant provide their service on their own way

- merchant integrate their backend service providers internally

- no standard to inter-operate/exchange services between multiple providers.

- a new standard is required

- de-centralized

- interoperabilitable

- between multiple service providers including payment and identity service providers.

Who is Service Provider

- Banking Web Service

- Mobile App

- Identity Web Service

- Delivery Web Service

- Currency Exchange Web Service

- Shopping Web Service

Data Formats for ECIS

- JSON/XML messages can be used for ECIS

- example) IETF ECML (http://tools.ietf.org/html/rfc4112)

Protocols with ECIS

- Any protocols which is handling message based data are available

- HTTP Request/Response

- Custom URI Scheme

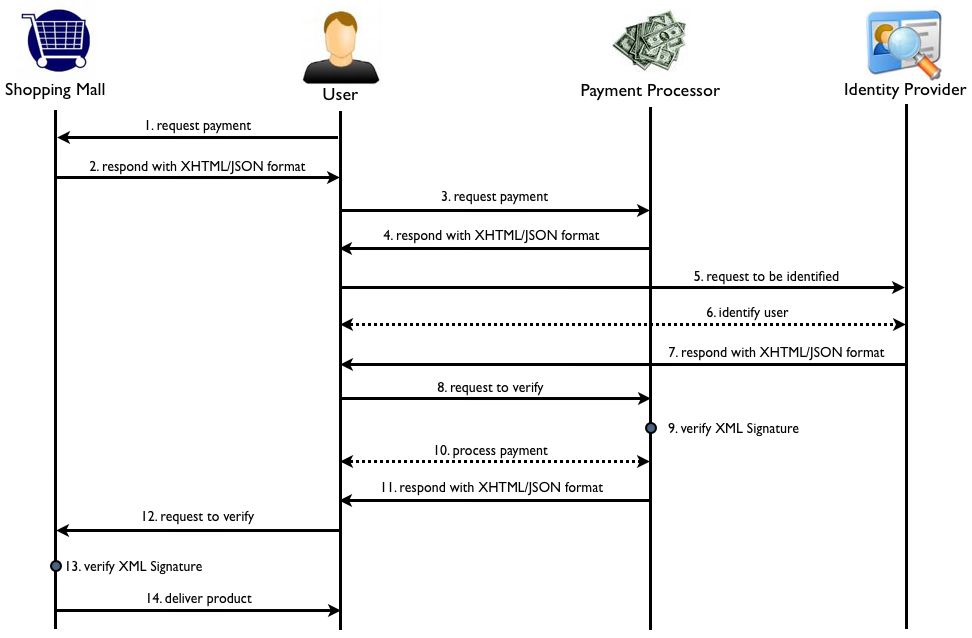

ECIS Sequence Diagram

- User(UA) send request payment to Shopping Mall

- shopping mall response request-token as XHTML/JSON format

- the request-token can be signed by merchant

- the token data can be formatted by ECML or JSON Web Token or others

- UA redirect the request-token to Payment Processor

- Payment processor response request-token to UA

- Payment processor need to identity user but they are unable to identity user.

- UA redirect the request-token of payment processor to Identity Provider

- Identity Provider identify user

- depends on ID providers

- Identity Provider response result as XHTML or JSON format

- the result can be signed by Identity Provider

- UA redirect the result to Payment Processor

- Payment Processor verify the result

- normally XML Signature verification can be used

- Payment Processor process payment with User

- Payment Processor response payment result

- the result can be signed by payment processor

- the formats can be XHTML or JSON

- UA redirect the result to Shopping Mall

- Shopping Mall verify the result sent from Payment Processor

- Shopping Mall deliver product/service to User

Centralized by User Agent

- between multiple service providers, the mechanism is de-centralized

- but it is User Central

- User Agent is the central point organizing decentralized operations

Considerations

- Timeouts

- Shopping Mall can not wait too much time

- but user know what is under processing

- Trust-Anchor between service providers

- Trust Each Other

- Use PKI

References

- ECML : http://tools.ietf.org/html/rfc4112

- SAML : http://en.wikipedia.org/wiki/SAML

- XML Encryption : http://en.wikipedia.org/wiki/XML_Encryption

- SAML : http://en.wikipedia.org/wiki/Security_Assertion_Markup_Language

- OpenID : http://en.wikipedia.org/wiki/OpenID

- OAuth : http://en.wikipedia.org/wiki/OAuth

Author

Mountie Lee (talk) 12:44, 27 October 2014 (UTC) PayGate (www.paygate.net)